12 June 2025

Chinese FDI in the Western Balkans has increased substantially, but won’t catch up with EU FDI any time soon. Governments must ensure that China’s investments comply with environmental and labour standards. Attracting high-quality FDI should be the goal

image credit: unsplash.com/vxhorse

This article draws on data from the GEO-POWER-EU INTERDEPENDENCE DATABASE (2025) to examine Chinese and EU foreign direct investment (FDI) trends in the Western Balkans, particularly in relation to economic influence, strategic positioning and recent political developments.

Recent trends in Chinese and EU FDI in the region

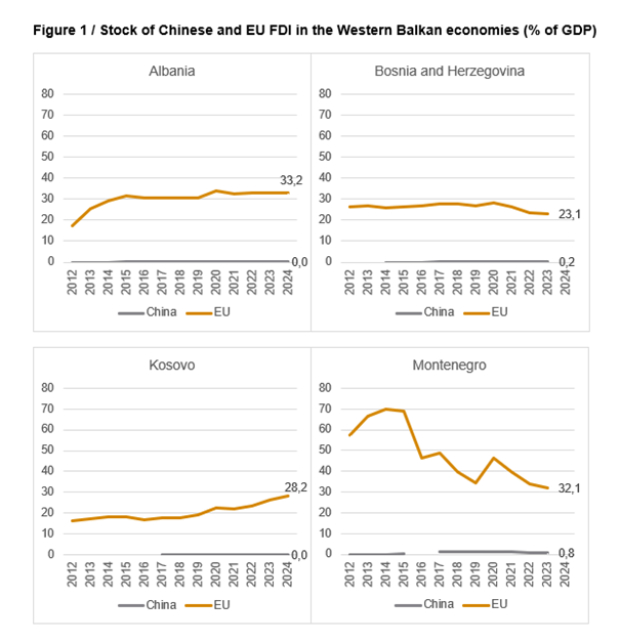

Despite all the talk, Chinese FDI in the Western Balkans remains fairly negligible in most economies. The stock of Chinese FDI in the region – that is, the total cumulative investment by Chinese companies over the years – is close to 0% of GDP in Albania, Bosnia and Herzegovina, and Kosovo. In Montenegro and North Macedonia, it is slightly higher, but still below 1% of GDP. Only in Serbia is the figure somewhat more substantial, with the stock of Chinese FDI in 2024 estimated to have been nearly 9% of GDP (Figure 1). In contrast, EU FDI remains significantly larger across the region, ranging from 23% of GDP in Bosnia and Herzegovina to 38% in Serbia.

Figure 1 / Stock of Chinese and EU FDI in the Western Balkan economies (% of GDP)

Source: GEO-POWER-EU Interdependence Database.

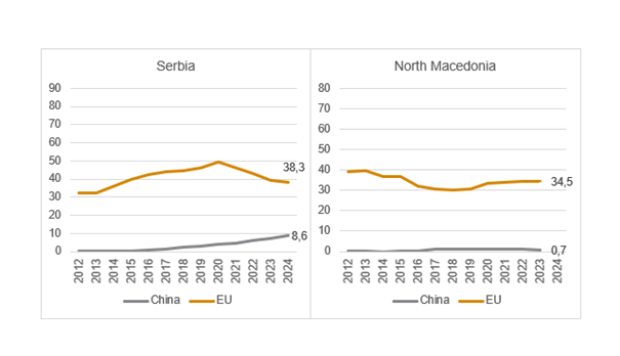

Still, when looking at the trends for the region as a whole, it is clear that the share of Chinese FDI is growing – pretty rapidly – while that of the EU is experiencing a decline – albeit only a mild one. In 2015, Chinese companies accounted for just 0.2% of the region’s GDP. By 2024, that share had increased twentyfold to reach 4.2% of GDP. In contrast, EU FDI peaked in 2020 at 40% of regional GDP. Since then, it has been on a gradual downward trajectory, falling to 34% by 2023 (Figure 2).

Figure 2 / Stock of Chinese and EU FDI for the region as a whole (% of GDP)

Source: GEO-POWER-EU Interdependence Database.

Serbia as the centre of Chinese FDI in the Western Balkans

Chinese FDI in the Western Balkans is almost entirely concentrated in Serbia. Of the total stock of EUR 5.6bn in 2023, EUR 5.4bn – or 96% – was in Serbia alone. Most of this investment has gone into sectors often considered low quality or environmentally and socially controversial, such as mining, metals and low-tech manufacturing. Notable examples include the Smederevo steel factory, the Bor copper mine, the Linglong tyre plant and the Čukaru Peki copper and gold project.

In recent years, however, Chinese investment has begun to shift towards sectors with higher value added. This includes automotive component production by Minth and Mei Ta, the Hisense appliance factory in Valjevo, and a EUR 2bn investment in renewable energy infrastructure by Zijin Mining in eastern Serbia.

Much of the output from these companies is exported to the EU, with Serbia serving as a kind of gateway for China to access the European market. At the same time, a growing share of copper from the Chinese-owned mines is now being shipped direct to China, contributing to Serbia’s rising exports to the Chinese market.

Why is China investing in the region?

It would be wrong to attribute China’s growing investment presence in the Western Balkans solely to geopolitical considerations. Economic motives are just as important. China’s expanding role in the global economy is naturally accompanied by a broader international investment footprint. At the same time, the country is shifting its economic model – from one based primarily on domestic investment and low-cost manufacturing to one centred on technology and high-quality production. In this context, China is increasingly focused on exporting capital, technology and production capacity. This outward push is also about securing new markets and building global brands – a development path followed by other Asian powers as well, like Japan and South Korea. Additionally, comparatively weak regulatory frameworks and enforcement in the Western Balkans make the region attractive to Chinese investors.

Political motives, of course, are also at play. The Balkan region holds strategic importance within China’s Belt and Road Initiative, which aims to expand China’s global influence through infrastructure, trade and investment. The region is seen as a convenient gateway to the EU, a view reinforced by Chinese FDI in neighbouring Hungary. From China’s perspective, the Balkans – especially the former Yugoslav republics – are also considered friendly ground, thanks to historically positive relations.

Why is the region welcoming Chinese FDI?

The main reason why Western Balkan countries have been open to Chinese investment is that, unlike many Western countries, they do not have a broadly negative view of China. The region has historically maintained friendly relations with China. Unlike Yugoslavia, China was not a full member of the Non-Aligned Movement, although it held observer status and maintained mostly positive ties with its members during the Cold War – especially after Mao Zedong’s death – a legacy that continues to shape perceptions today.

The region also needs foreign direct investment. Since the fall of socialism, FDI has been a central pillar of its development strategy, and is viewed as a key source of capital, employment and technology. In some cases, Chinese companies stepped in where others were unwilling to – taking over large, loss-making industrial giants such as the Bor mine and the Smederevo steel plant, thereby preserving thousands of jobs and helping to prevent further industrial decline.

Finally, there may also be geopolitical considerations on the side of the Western Balkan governments. Given the EU’s slow and often hesitant approach to enlargement, some countries may now be seeking to diversify their partnerships and to signal that they have alternatives. Accepting Chinese FDI may be a way of increasing their bargaining power and repositioning themselves in a more multipolar global context.

What is to be done?

One must accept that China’s presence will continue to grow in the Western Balkans – just as across much of the world. China now accounts for around 17% of global GDP – the same as the EU – up from just 4% two decades ago, so it is only natural for its economic footprint in the region to expand as well.

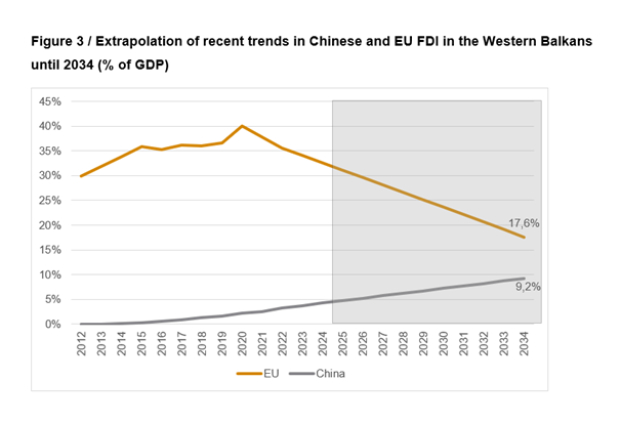

At the same time, it is highly unlikely that Chinese FDI will catch up with EU FDI in the region any time soon. A simple extrapolation of recent trends suggests that the gap will remain substantial over the next decade. If Chinese FDI continues to grow at its current pace – with its share of total FDI stock increasing by about 0.5 percentage points per year – by 2034, China will hold around 9.2% of the region’s total FDI stock. Meanwhile, even if EU FDI continues its recent decline of 1.5 percentage points annually, its share will still be 17.6% in 2034 – nearly double that of China (Figure 3). One also has to bear in mind that this extrapolation likely overstates the trend, as it is based on a period marked by unusually weak EU investment activity.

Figure 3 / Trends in Chinese and EU FDI in the Western Balkans until 2034 (% of GDP)

Note: The shaded grey area indicates the extrapolation period.

Source: GEO-POWER-EU Interdependence Database and author’s calculation.

The EU should therefore not aim to prevent China’s presence in the region. In any case, there is little it can do to stop it. Measures applied within the EU – such as due diligence requirements or investigations into unfair state aid – cannot be enforced in the Western Balkans, as the region remains outside the Union. If the EU wishes to respond, it should do so in a proactive way – by supporting high-quality European FDI in the region, though even this remains limited, as such investment ultimately depends on decisions made by private companies, not public institutions.

It is thus up to Western Balkan governments themselves to approach Chinese FDI with greater caution. These investments should not be accepted unconditionally. Several projects have been linked to pollution, environmental degradation and violation of workers’ rights. Governments should work to prevent such abuses by strengthening regulatory oversight and enforcement.

More broadly, while the region should remain open to Chinese FDI, it should shift its focus from attracting any investment to attracting the right kind – high-quality FDI that supports sustainable development. That means moving away from extractive industries and low-tech, labour-intensive manufacturing, and prioritising high-tech sectors with high value added. The region’s labour pool will not remain abundant forever – shortages are already looming. Achieving long-term prosperity and avoiding the middle-income trap will require the region to upgrade the quality of investment it attracts.

This blog post includes insights derived from the database developed as part of the GEO-POWER-EU project. The project has received funding from the European Union’s Horizon Europe research and innovation programme under grant agreement No. 10113292. The content of this post does not necessarily reflect the views of the European Commission. The EC is not liable for any use that may be made of the information contained herein.

Courtesy of The Vienna Institute for International Economic Studies

The post What’s driving Chinese FDI in the Western Balkans – and what should be done about it? appeared first on Tirana Times.